GTR Magazine looks at the state of travel and tourism in the Caribbean

The Caribbean saw growth across most key markets in 2024. According to Caribbean Tourism Organization (CTO), during the first nine months of the year, the tourism sector demonstrated a strong recovery, with growth in both visitor arrivals and cruise visits. More specifically, year-on-year growth in tourist arrivals ranged from 0.3% to 29.4% and only three destinations recorded declines. Montserrat experienced the highest growth, with a 29.4% increase.

“Tourism continued to grow within forecast ranges throughout the first nine months of the year, driven by sustained strong travel demand from the United States and increasing demand from Canada. This growth was further supported by enhanced air connectivity, including new routes and increased flight frequencies, as well as diversification efforts aimed at reducing seasonality,” says Aliyyah Shakeer, Director of Research.

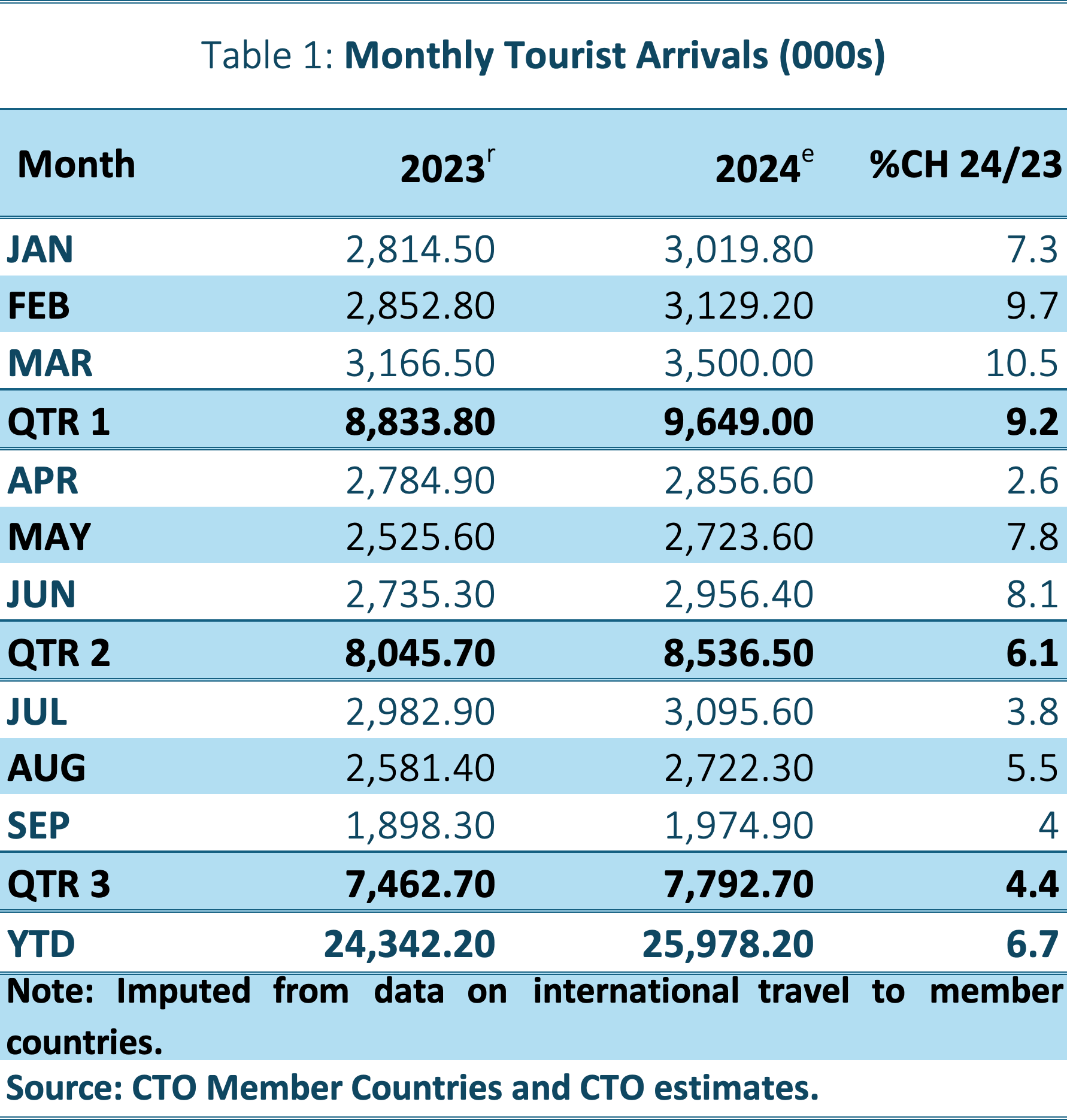

Between January and September, the Caribbean welcomed an estimated 26.0 million international tourist arrivals, marking a 6.7% increase compared to the same period in 2023

Tourist arrivals

Between January and September, the region welcomed an estimated 26.0 million international tourist arrivals, marking a 6.7% increase compared to the same period in 2023. “The year-to-date total arrivals not only surpassed all previous comparable periods, but also exceeded the benchmark year of 2019 by 5.9%,” states Shakeer.

With 13.0 million arrivals (an increase of 4.7%), the United States remains its largest source market at 50%. Canada made up 9% of visitors, with 2.3 million arrivals (an increase of 7.4%).

Drawing around 25% of the region’s total tourists, the Dominican Republic remains the top Caribbean destination, followed by Jamaica at approximately 9% and Cuba at around 7%.

“Tourist arrivals to the Caribbean in 2024 displayed a mix of recovery and growth, with most destinations seeing increases versus 2023. Smaller destinations typically experienced robust percentage growth, while larger destinations drew the majority of visitors, though some still have not fully returned to pre-pandemic levels,” she adds.

According to the ACI World Annual Traffic forecasts, passenger traffic at Caribbean airports is expected to grow by 3.3% CAGR (Compound Annual Growth Rate) between 2024 and 2030; by

2.6% to 2040 and 2.3% to 2050. This includes traffic in Puerto Rico, which is dominated by flows to and from mainland United States.

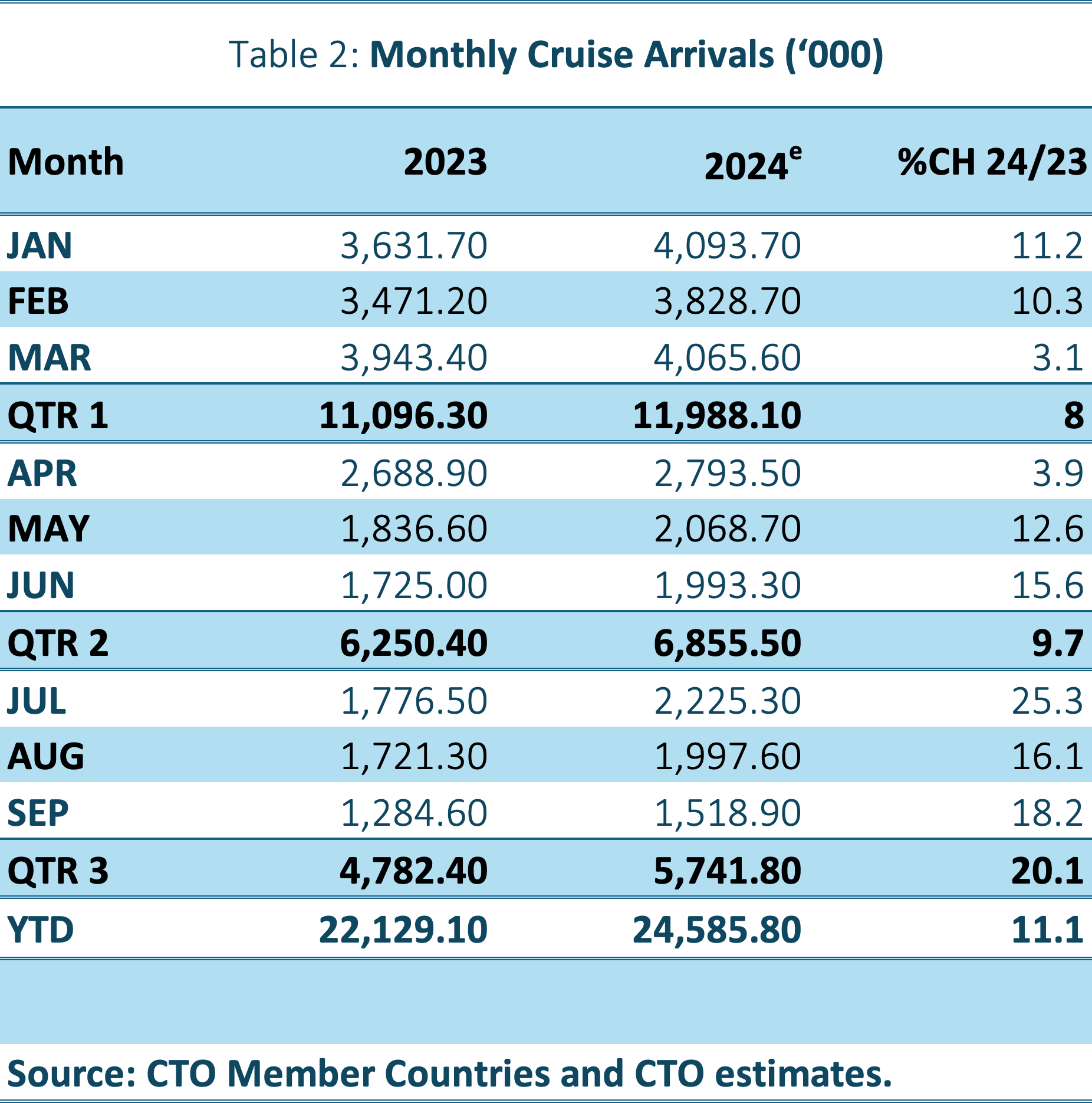

Data for the first nine months of 2024 showed steady growth in the Caribbean’s cruise tourism sector, with each month outperforming the same months in both 2023 and 2019

Air connectivity

As shared by Shakeer, to continue tapping into the growing demand for multi-destination travel in the Caribbean, airlines and destinations need to focus on enhancing regional connectivity via numerous strategic initiatives. For example, she points out, establishing agreements to boost air services and reducing taxes on airline tickets would make intra-regional travel more affordable and accessible.

Shakeer explains, “Increased collaboration between airlines, governments and tourism authorities is crucial for aligning regional carriers with international networks, ensuring smoother connections for travelers. Utilizing data-driven strategies to analyze past successes and failures will help refine these efforts while engaging finance ministers in strategic financial planning, which is essential for long-term sustainability.

“Operational improvements, such as extending airport hours to accommodate better flight schedules and introducing seasonal fares to encourage off-peak travel, would also further enhance connectivity. Harmonizing regulations across the region is also vital to streamline operations and reduce barriers to travel.”

With the aim to drive connection among more destinations across the Caribbean, particularly CTO member states, the CTO Airlift Committee, a sub-committee of the Board of Directors, was established in February 2024.

“A key aspect of airport management is route development, that is the efforts made by airports to develop existing services and attract new airlines or add new destinations. This is particularly important in the Caribbean given the relatively small volume of traffic at most airports. Hence the reason why ACI is pushing for the liberalization of air services within the Caribbean as an essential tool to maximize the potential of each destination,” says Rafael Echevarne, Director General, Airports Council International – Latin America and Caribbean.

Passenger experience

The passenger experience, and more specifically, the immigration experience, is an important element of airports in the Caribbean, as it has a direct relationship with the overall impression and competitiveness of the destination. Echevarne reports that there is an increasing number of Caribbean countries implementing biometric border control processes and cites Aruba and Barbados as excellent examples of those using technology to expedite passenger processing. Paper-based customs forms are also being replaced with online systems.

Cruise tourism

The Caribbean experienced an increase of 11.1% in cruise arrivals from January to September last year, with an estimated 24.6 million cruise visits during this period. This figure represents a 12.4% rise compared to the same period in 2019.

“Preliminary data for the first nine months of 2024 showed steady growth in the Caribbean’s cruise tourism sector, with each month outperforming the same months in both 2023 and 2019. This highlights the sector’s ongoing recovery and expansion. Compared to 2023, growth ranged from 3.1% in March to 25.3% in July. Compared to 2019, the most significant growth occurred in March (20.7%), while January saw the smallest increase at 2.1%,” reports Shakeer.

Trinidad & Tobago saw the highest growth, with a 31.8% increase in cruise passengers (January – April). This was followed closely by Turks & Caicos with a rise of 29.7% (January – September).

Developments in Caribbean cruise tourism include new ships, ports, destinations and expanded offerings. Notably, managed by Global Ports Holding, the Saint Lucia cruise port redevelopment project has launched, featuring an enhanced passenger experience, state-of-the-art facilities and new berthing capabilities for larger ships. Coming up, Carnival Cruise Line is set to open Celebration Key in July 2025, a major new cruise destination in the Bahamas with a strong culinary focus including multiple restaurants, food trucks, snack shacks and bars.

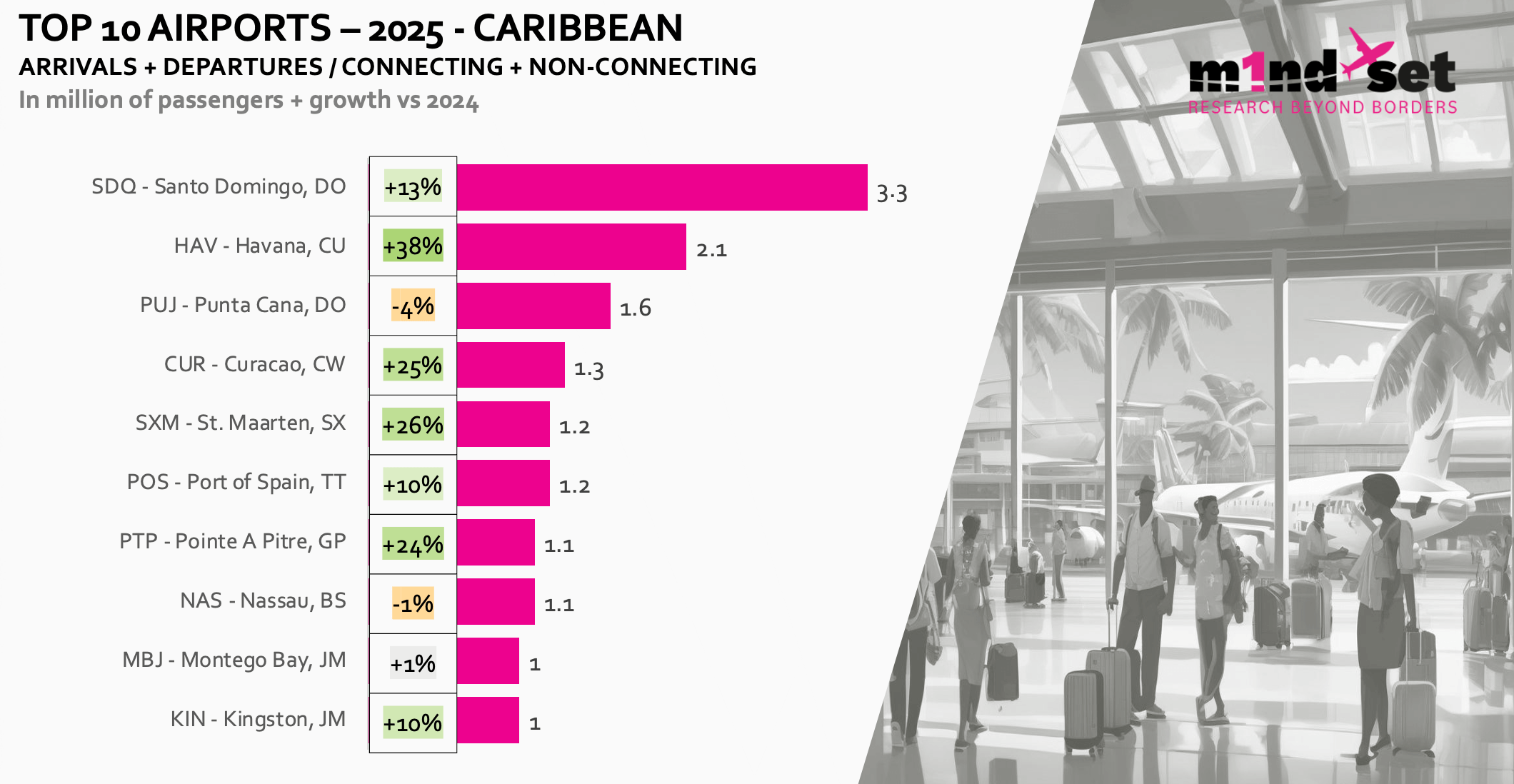

Hosting 3.3 million international travelers in 2024 (an increase of 13% versus 2023), Santo Domingo remainsthe number one Caribbean airport by air traffic

Duty free shopping

When it comes to the performance of airport duty free shops in the Caribbean, m1nd-set reports positive news. According to the travel research agency, the purchase rate in the region is 27%. Gen X shoppers (45 – 60 years) are the most likely to browse, but the least likely to convert into buyers; Gen Z shoppers (13 – 28 years) demonstrate the opposite behavior. “The challenge lies therefore in motivating the younger generation to browse airport stores in the first place,” the team says.

Below is a snapshot of the duty free channel in the Caribbean, as shared by m1nd-set:

- Confectionery and food (including chocolate) is the most purchased category at 33%, followed by alcohol (28%), perfumes (21%), tobacco (20%) and souvenirs and gift items (15%)

- While confectionery and chocolate ranks number one, only 6% of the wallet is dedicated to this category

- Duty free shoppers are open to buying never before purchased products (65%); products perceived as unique or exclusive to travel retail are of high interest

- The planning level of purchase is diverse with both generally planned shoppers (51%) and impulsive shoppers (27%) highly influenced by in-store elements and experiential retail

- A combination of elements motivates shoppers to make a purchase including good value for money (24%), along with more practical aspects such as convenience and time

- The top barrier to purchase among shoppers is the unwillingness to carry more (23%)

Hosting 3.3 million international travelers in 2024 (an increase of 13% versus 2023), Santo Domingo remains the number one Caribbean airport by air traffic. With slightly more than 2.0 million international travelers, Havana Airport follows with an impressive 38% growth compared to 2024.

The Caribbean Rum Collection located in Runway Duty Free at Grantley Adams International Airport in Bridgetown, Barbados

A word from ARI

Aer Rianta International (ARI) operates three duty free stores at Grantley Adams International Airport in Barbados. Nuno Amaral, Chief Operations and Business Development Officer at ARI, says the operator has seen a strong performance year-on-year with double digit growth versus 2023.

“A big focus for us – across all our operations – is on sense of place, ensuring that we can create an authentic and memorable experience for passengers. This covers the entire customer journey, from store design to brand and product assortment, complementing leading international brands with the best of local.

“Barbados has such a diverse and colorful local culture, and the team expertly bring this to life in our stores. We have built a strong partnership with the airport, which is currently exploring options for the redevelopment of its passenger terminal. We’re excited to work collaboratively with them to develop our retail footprint in line with the airport’s commercial vision,” shares Amaral.

As one of the operator’s more seasonal locations, with travel peaks during the winter months of November to April, and again in the summer months of July and August, its team in Barbados is

well positioned to maximize on growing footfall during peak seasons and convert more travelers into shoppers. ARI recently completed work on its new customer segmentation model as part of the Future Customer Initiative, which according to Amaral, ensures that ARI can be even more agile in tailoring its offering across each of its locations to meet specific passenger needs.

Source: Global Travel Retail Magazine

MORE NEWS